How can payment terms help to scale the food & beverage industry?

The food & beverage industry’s estimated worth was 5.34 trillion euros in 2022. That will push up to 8.47 trillion euros by 2027.

Brick and mortar shops have traditionally carried out wholesale food & beverage buying and selling. Trade credit has been offered manually. However, this changed in 2020 when we witnessed a massive shift to online purchasing. There was a 51.6% year-on-year increase of online purchasing for food and 39.3% for beverages. Despite this, deferred payment options in the B2B food & beverage market are still not the standard offer for buyers. Banks have not responded to the increased demand for online trade credit.

The good news is this is now changing fast! Companies like Terms.Tech have developed a win-win solution for buyers and sellers. Buyers put off the payment until later with digital trade credit via payment terms. Meanwhile, sellers receive cash up front.

5 reasons to choose Terms.Tech as your payment terms provider

Enhance customer experience

B2B customers love to pay for goods with credit. Offer Terms.Tech’s payment terms at your checkout and watch your conversion rates increase while you attract new customers. Flexible. Fast. Easy to use.

Fast and consistent cash flow

Your cash flow and working capital are key to a successful business. We pay you up front and the buyer pays us back via payment terms up to 90 days or in instalments. It’s a win-win for you and your customers.

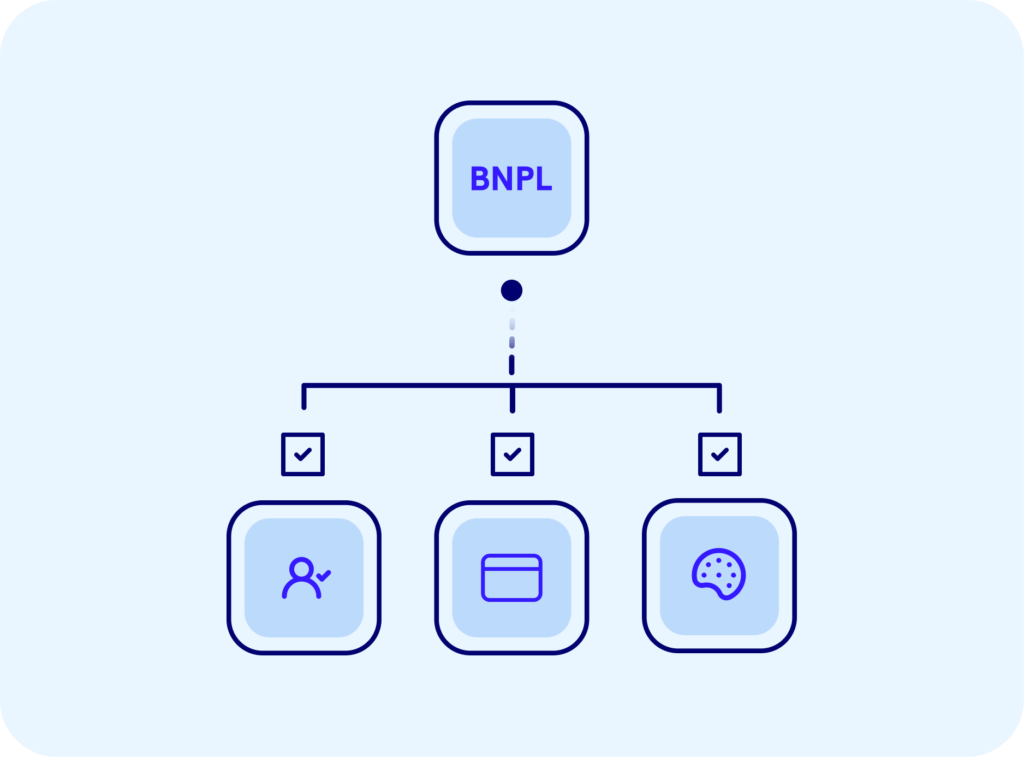

Fine-tuned credit check

Give your business the reputation it deserves. With our in-house-developed eligibility assessment tool, you can rest assured that we extend payment terms only to those with a good credit rating. Not only is our process lightning fast, it takes the pressure off of you to run your own checks.

Risk-free terms

Any non-payments? That’s not your problem anymore! Our Buy Now, Pay Later solution is completely risk-free for you. Any payment defaults due to fraud or non-payment are on us. This way you can reduce your risk while focusing on what you do best. Terms.Tech helps you to build your business wisely and safely.

Ready to grow your business with us?

Sell more and increase your revenues with our fully customised Buy Now, Pay Later solution